Overview

Fund focussed on low volatility infrastructure investments in the UK.

Key stats

2017

vintage£950 million

total commitments11

investmentsFully invested

status

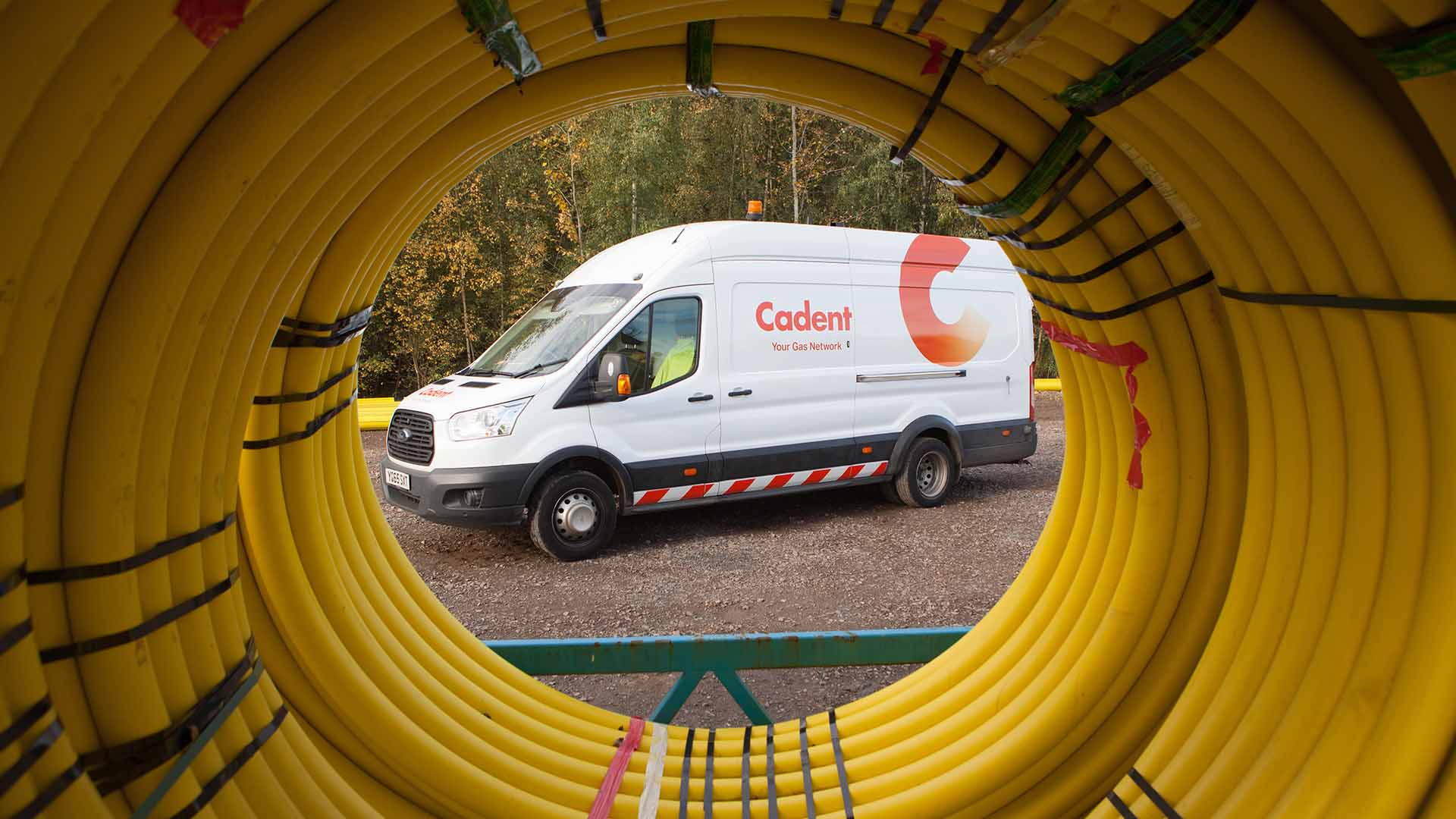

Cadent Gas

- Dalmore Capital Fund 3

- Energy & Utilities

Largest distributor of gas in the UK, owning and operating four of the eight regulated gas distribution networks.

Find out morePortfolio investments

Thameslink

Rolling stock leasing company comprised of 115 electric trains operating the UK Thameslink rail franchise.

Thameslink

- March 2019

- Dalmore Capital Fund 3

- Transport

IEP West

Concession to maintain 57 Hitachi Intercity Express Trains and three depots for the Great Western Main Line.

IEP West

- December 2018

- Dalmore Capital Fund 3

- Transport

Jura

Diversified portfolio of 32 operational PPP assets acquired via the take private of JLIF plc. Assets span Education, Healthcare, Transport and Social Infrastructure sectors and are located in the UK, Continental Europe and Canada.

Jura

- October 2018

- Dalmore Capital Fund 3

- Social Infrastructure

EDF Wind

562.5MW utility scale portfolio of operational, predominantly onshore wind farms across the UK.

EDF Wind

- July 2018

- Dalmore Capital Fund 3

- Energy & Utilities

Cory

Largest Energy from Waste plant in the UK processing up to 780,000 tonnes of waste per annum. The company has a sustainable approach to the transport of waste, using four transfer stations based on the River Thames and a fleet of tugs and barges to transfer waste to the plant.

Cory

- June 2018

- Dalmore Capital Fund 3

- Energy & Utilities

Cadent Gas

Largest distributor of gas in the UK, owning and operating four of the eight regulated gas distribution networks.

Cadent Gas

- May 2018

- Dalmore Capital Fund 3

- Energy & Utilities

Anglian Water

Supplier of water and water recycling services to almost seven million domestic and business customers in the east of England and Hartlepool.

Anglian Water

- February 2018

- Dalmore Capital Fund 3

- Energy & Utilities